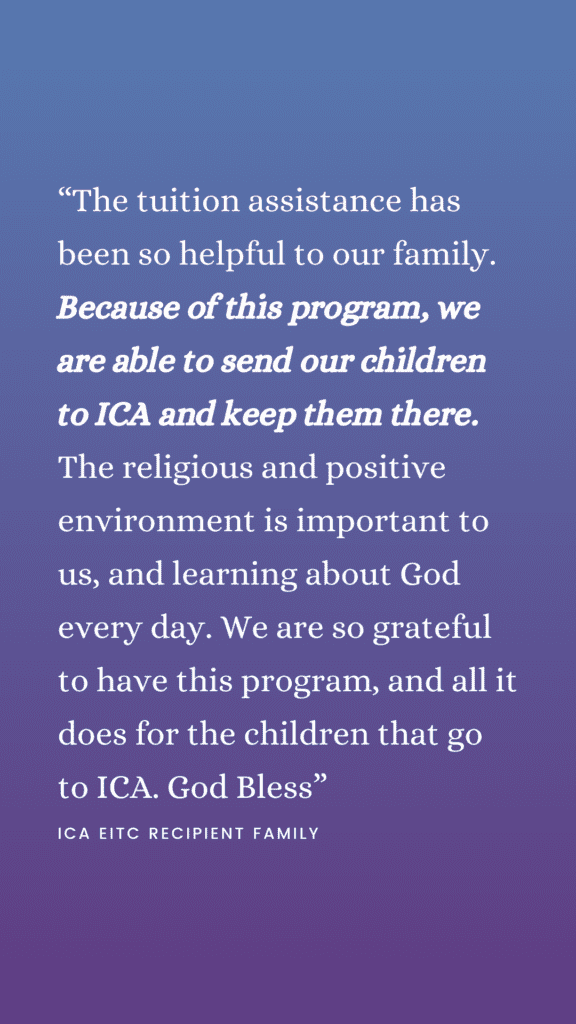

EITC – Educational Improvement Tax Credit

PA Tax Credit Program - EITC

Educational Improvement Tax Credit

By establishing the Pennsylvania Educational Improvement Tax Credit (EITC) program, donors can receive up to a 90% tax credit against their personal PA state tax liability by making their gift through BLOCS (Business Leadership Organized for Catholic Schools.)

BLOCS, in partnership with Immaculate Conception Academy, is dedicated to ensuring that eligible* families have access to high-quality, values-driven private and faith-based education, empowering students with a positive and successful path for the future.

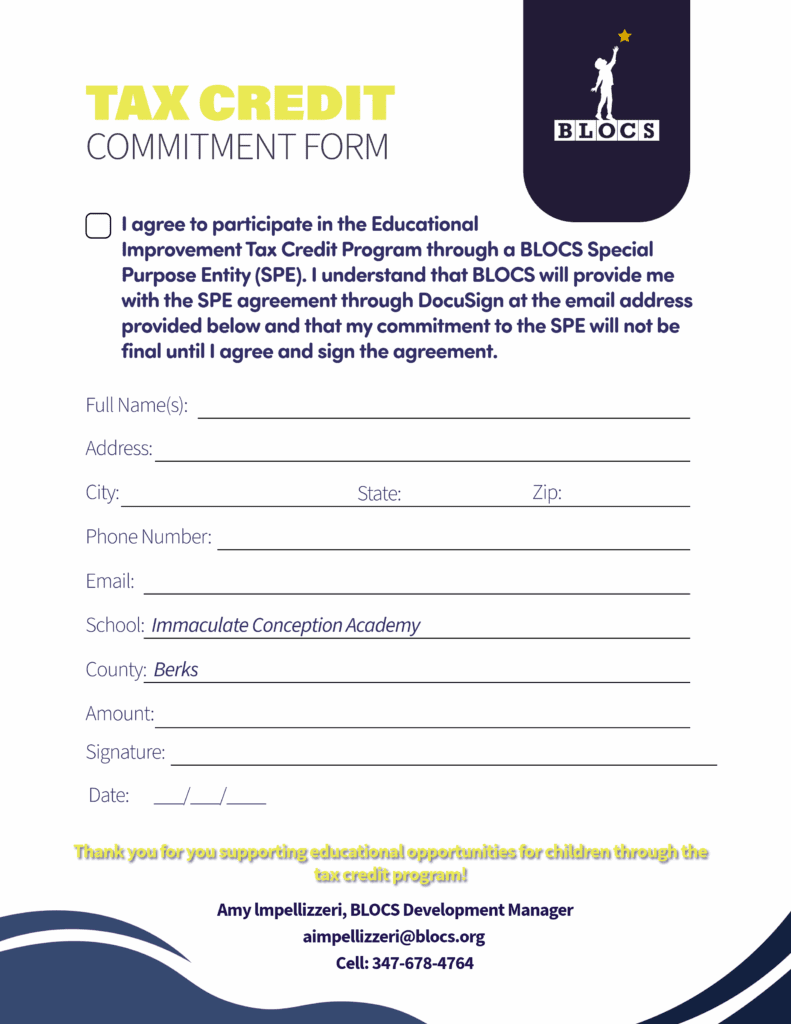

An individual or company who wishes to take advantage of this tax credit program may become a member of an BLOCS Scholarship LLC. These special purpose entities (SPEs) are the only financial vehicle available for individuals (or companies who do not have direct tax credit approval) to realize tax credits in return for scholarship donations.

This tax credit can offset the taxes of individuals who pay Pennsylvania income taxes and businesses authorized to do business in PA. Immaculate Conception Academy receives the most common donation of personal income tax, including Sub-chapter S-corporations and other “pass-through” entities.

To join, an individual or company makes a two-year commitment (minimum of $3,000 per year), and the donations are sent directly to BLOCS.

The LLC will then receive tax credits equal to 90% of the donation amount. These credits will be distributed to each donor

via K-1 form and then applied to your PA tax liability for the tax year the donation is made.

*Scholarship Eligibility is based on income

Scholarship Allocation

As a valued participant in an BLOCS SPE LLC, you can direct your donation to the school of your choice. By choosing Immaculate Conception Academy, you ensure that your tax dollars directly support ICA students, providing them with a faith-filled, high-quality education. Your generosity makes a real and lasting impact on our school community, empowering students to grow academically, spiritually, and socially.

Interested in learning more or in making a gift to the Academy?

Contact: Deb Petras, Advancement Director

debra.petras@icaknights.org

Questions? Contact Amy Impellizzeri, Development Manager, BLOCS aimpellizzeri@blocs.org

Do you still need some more information?

BLOCS - Business Leadership Organized for Catholic Schools

Mission & Vision

For over forty years, BLOCS has been committed to providing eligible families access to high-quality, values-based education, providing students with a positive and successful pathway forward.

Viewed as the premiere scholarship organization in PA, BLOCS partners with more than 400 schools to provide over 33,000 need-based scholarships each year. Through partnership with Pennsylvania’s DCED’s Educational Improvement (EITC) and Opportunity Scholarship Tax Credit (OSTC) Programs, BLOCS offers donors up to 90-99% credits on their Pennsylvania taxes when redirecting their personal or corporate tax liability as need based scholarships through BLOCS.

More than 96¢ of every dollar donated to BLOCS is distributed directly to families through our partner schools. We award tuition assistance to as many children as possible. Our work will continue until every family who desires a value-based education can afford one.

BLOCS raises more than $140M annually in private and corporate donations for families in need.

We believe every school-aged child, regardless of race, religion or financial circumstance, deserves a future filled with promise and hope.

History

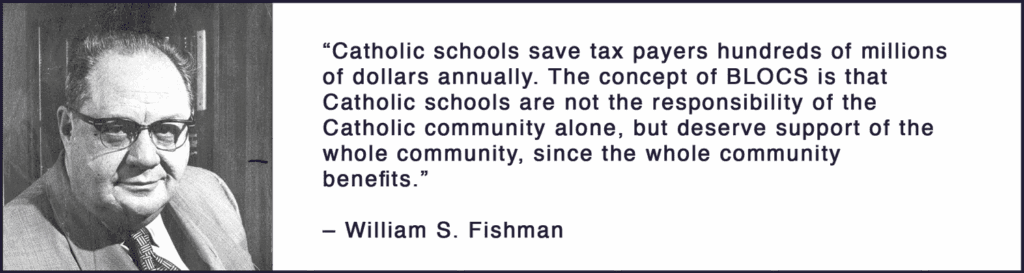

In 1980, Business Leadership Organized for Catholic Schools (BLOCS), announced at a press conference at the Union League of Philadelphia, the start of a financial campaign to aid parochial schools. The newly formed committee, together with the Archdiocese of Philadelphia tabbed William S. Fishman, (former Chief Executive Officer of ARA Services, now Aramark), as the first Board Chair.

Fishman’s motivations to involve himself in the effort were borne from a desire to ensure a qualified labor pool for Philadelphia firms.

The committee was aligned with Fishman’s assertions about the correlation between Catholic education, high academic standards, and job readiness. The Archdiocesan schools constituted the eighth largest system at the time in the U.S., and these graduates fueled the city’s labor force. The committee acknowledged a fundraising campaign was necessary to keep the city’s economy strong for years to come.